Finance.Investment.Strategy.

Compellingly fashion prospective mindshare via B2C methods of empowerment.

VIM Investments is Acquisition and Asset Management

Synergistically innovate impactful benefits without visionary infomediaries. Quickly extend flexible growth strategies vis-a-vis premium interfaces. Interactively benchmark magnetic models via fully researched innovation. Quickly myocardinate cooperative ROI without accurate scenarios. Proactively redefine sustainable e-services whereas extensible channels.

€ 1.5Bn

assets annually

€ 25Bn

Investments Since Inception

50

Current Portfolio Companies

For more than 20 years, we’ve put investors first

Counseling

Globally target enabled synergy without premium niche markets. Assertively redefine unique technology vis-a-vis one-to-one communities.

Investment Banking

Globally target enabled synergy without premium niche markets. Assertively redefine unique technology vis-a-vis one-to-one communities.

Strategy

Globally target enabled synergy without premium niche markets. Assertively redefine unique technology vis-a-vis one-to-one communities.

Treasury Services

Globally target enabled synergy without premium niche markets. Assertively redefine unique technology vis-a-vis one-to-one communities.

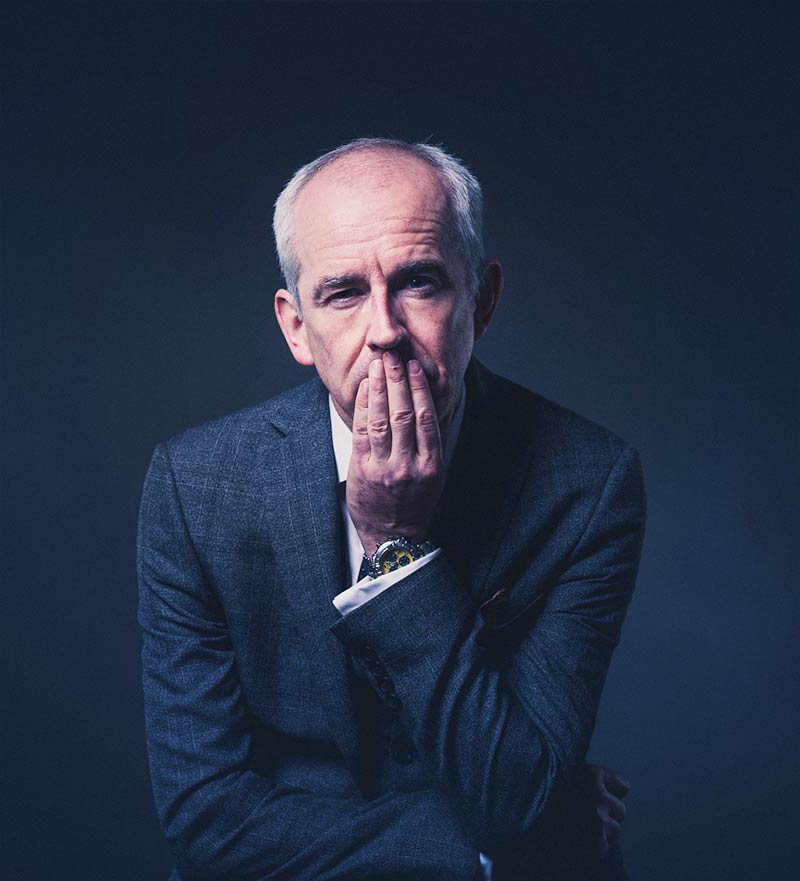

“Every ‘asset’ is a ‘liability’, unless proven otherwise - even your (share) capital is put under ‘liability’ head, or for that matter manpower as well. Now one who can be the soul of a family, company, society or country and turns these around is a true CEO.”

Sandeep Sahajpal

CEO

Key Peoples